Renters Insurance in and around Royal Oak

Welcome, home & apartment renters of Royal Oak!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Royal Oak Renters!

Your rented condo is home. Since that is where you make memories and rest, it can be beneficial to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your sports equipment, guitar, books, etc., choosing the right coverage can help protect your belongings.

Welcome, home & apartment renters of Royal Oak!

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented condo include a wide variety of things like your video game system, stereo, favorite blanket, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Linda Fisher has the dedication and experience needed to help you choose the right policy and help you keep your things safe.

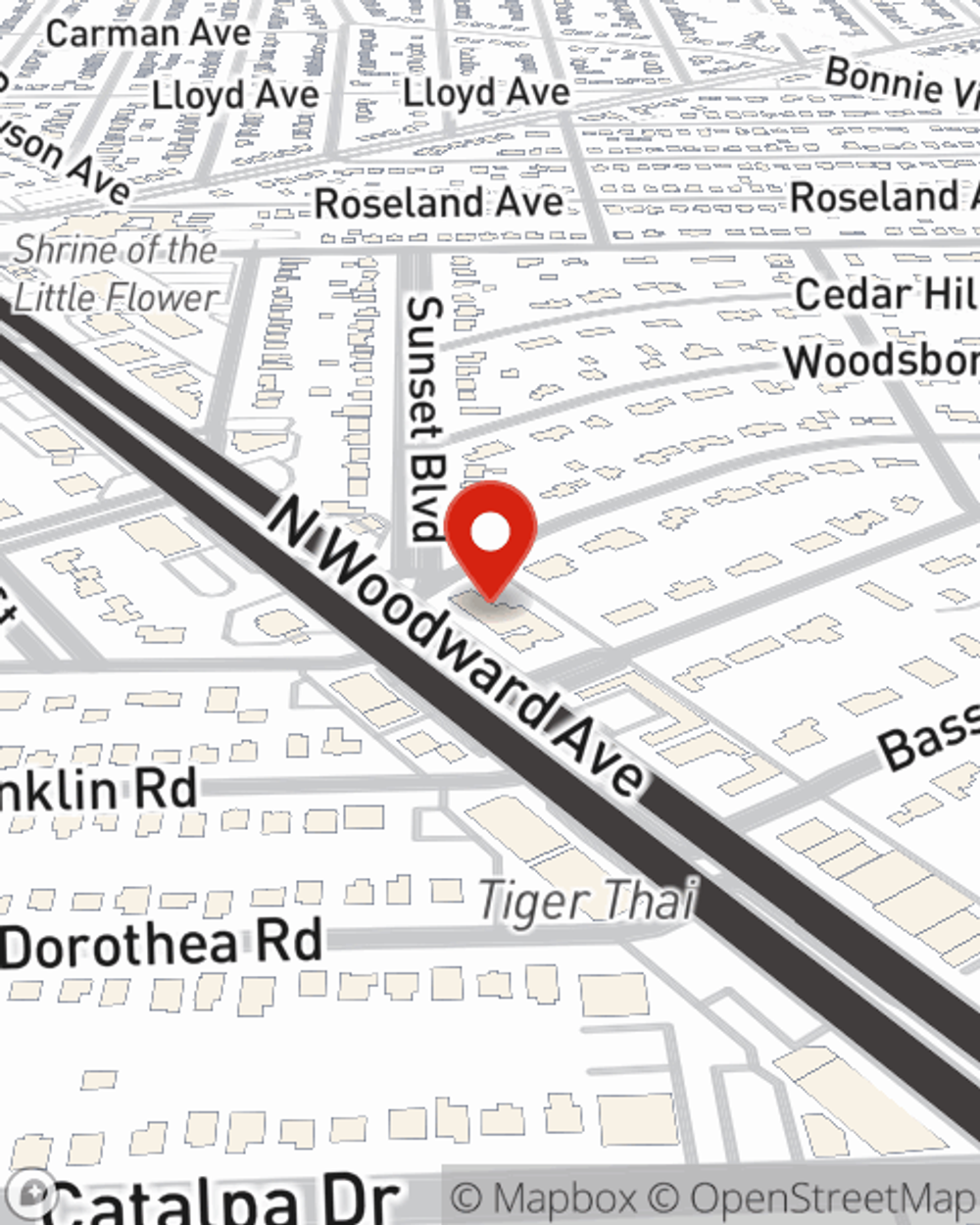

A good next step when renting a house in Royal Oak, MI is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and find out how State Farm agent Linda Fisher can help you.

Have More Questions About Renters Insurance?

Call Linda at (248) 543-5510 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Linda Fisher

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.